The German Federal Ministry for Economic Affairs and Climate Action (BMWK) recently published its hydrogen and derivatives Import Strategy. In the medium and long term, imports will account for a large portion of Germany’s demand for hydrogen, and Germany will be one of the world’s largest importers of hydrogen. As part of the energy partnership with the United Kingdom, talks are being held on the possible construction of a hydrogen pipeline between Germany and the United Kingdom (e.g. Scotland).

By 2030, the Federal Government expects German demand for hydrogen and derivatives to increase to 95-130 TWh, of which imports account for 50-70%. Demand for hydrogen and hydrogen imports will increase further as the transition of the economy towards climate neutrality progresses. By 2045 this demand for imports is expected to rise to 360-500 TWh of hydrogen and 200 TWh of hydrogen derivatives.

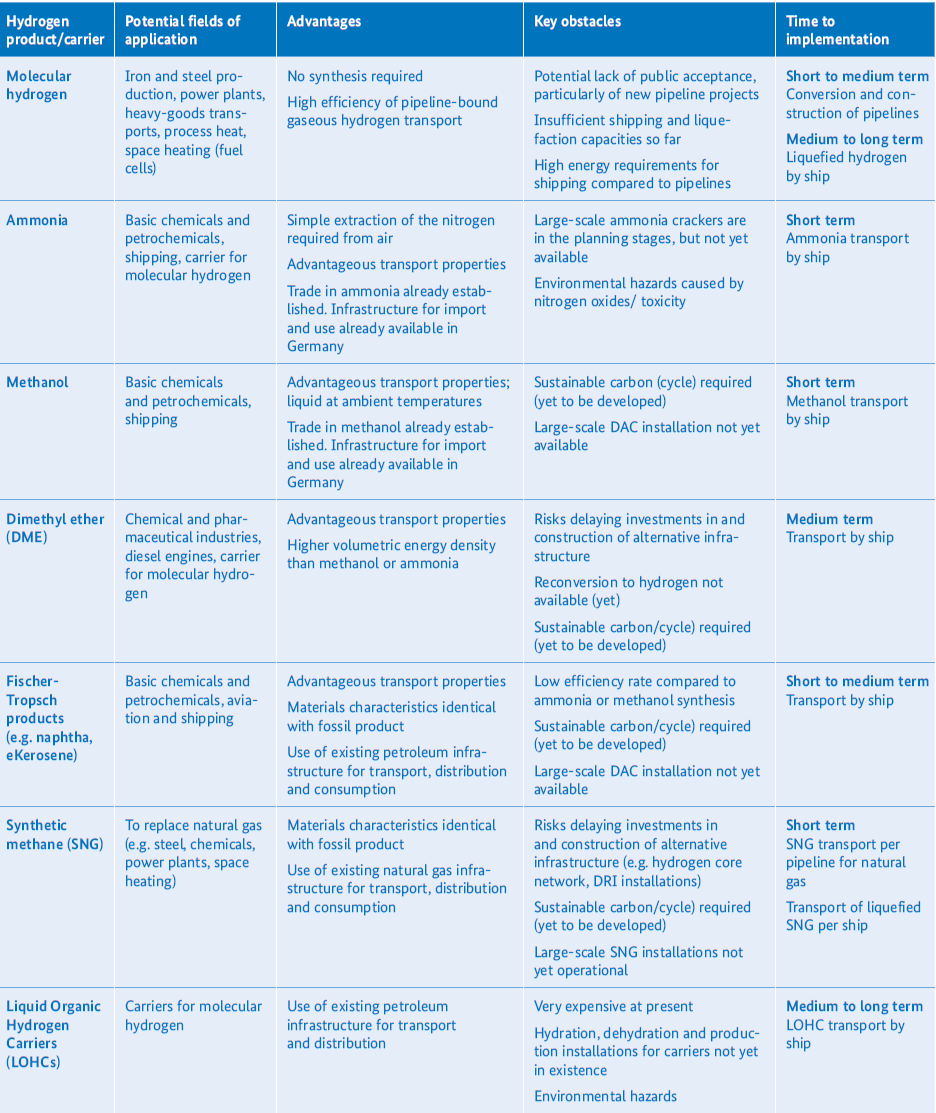

The Import Strategy supports a diversified product portfolio for hydrogen imports. Apart from molecular hydrogen (i.e. gaseous or liquid hydrogen which is not bound in derivatives), these could include various hydrogen derivatives (including ammonia, methanol, naphtha, power-based fuels) and hydrogen carriers (such as LOHCs). Each of these products has different characteristics appropriate for different use-cases and comes with its own advantages and challenges that need to be considered as import routes are being established.

The German Import Strategy also envisages the building of import infrastructure for transport by pipeline and ship, bearing in mind that using gas import infrastructure and its reengineering to accommodate hydrogen can result in cost savings. For molecular hydrogen, pipelines are a particularly cost-effective means of transport. In the medium term, a large portion of Germany’s hydrogen imports will likely be transported via pipelines, particularly enabling hydrogen imports from Europe and its neighbours to Germany.

Transportation by ship, railway line or road is considered an option mainly for hydrogen derivatives, carriers and downstream products. Shipping allows for hydrogen imports from countries that cannot be connected to Germany via pipeline for technical and/or economic reasons. For derivatives, the import strategy expects ship-based transport to remain efficient even in the long term, so it will probably play an essential role in the import mix.

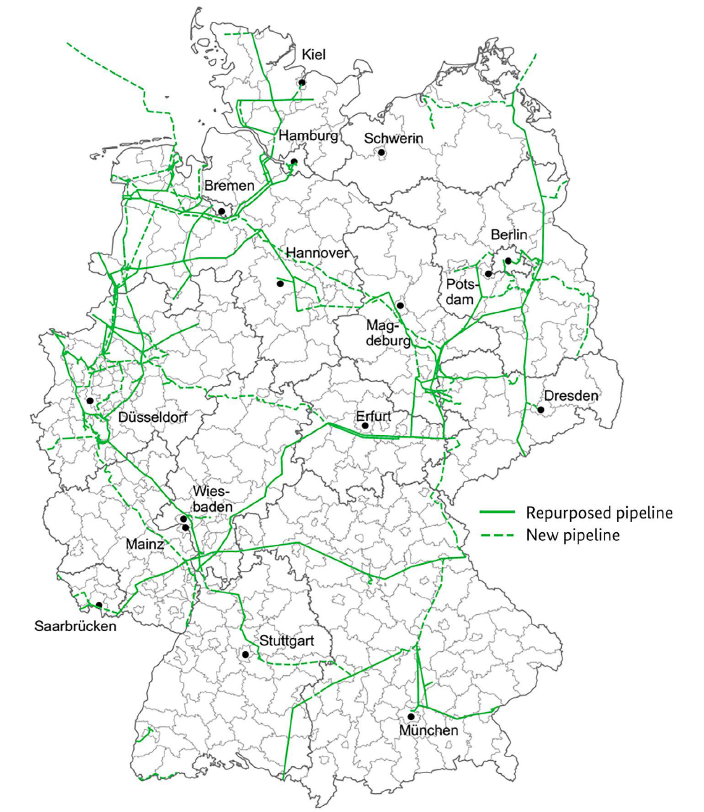

For Germany’s import needs to be met, it will be necessary to enable and support cross-border transport of hydrogen and its derivatives. To this end, the Federal Government is focusing simultaneously on the construction of both pipeline-based import infrastructure and of import terminals. In Germany, the Federal Government is advocating the construction of a meshed, pipeline-based hydrogen network to be able to transport and distribute imported hydrogen across the region. The hydrogen transport network will be built in two stages. In the first stage, a hydrogen core network is to be gradually built up by the target year 2032.

This hydrogen core network will connect key hydrogen locations across Germany, including electrolysers, import terminals and pipelines, industrial centres, power plants and combined heat and power plants, and underground storage facilities.

On 22 July 2024, the gas transmission system operators, as future hydrogen network operators, submitted a joint application for a core network to the Federal Network Agency (BNetzA) that will be around 9,700 km long and built between 2025 and 2032. It will comprise roughly 60% repurposed natural gas pipelines and 40% newly built hydrogen pipelines.

According to the current planning status, 15 interconnectors will be an essential part of the German core network. The question of how to stimulate the necessary Europe-wide infrastructure investments quickly remains highly relevant. The Federal Government is proactively involved in developing a European financing concept for hydrogen infrastructure and is pursuing this as a strategic, joint European project.

The reliable international ramp-up of the market for hydrogen and its derivatives also requires ambitious and workable sustainability standards and transparency regarding the properties of the hydrogen products being traded. Climate-related product specifications in Germany are rooted in European legislation, particularly the Renewable Energy Directive and the Internal Gas and Hydrogen Market Directive.

Targeted research and development will also help foster the ramp-up of the international hydrogen market. The Power Plant Security Act and the capacity mechanism of the Federal Government have created the framework for investments in flexible and climate-friendly power stations in Germany. In the short term, this includes inviting tenders for new power plant capacities for hydrogen-capable gas-fired power plants. These hydrogen-ready gas-fired power plants will be fully converted to hydrogen 8 years after commissioning. In addition, as part of applied energy research, funding will be provided for 500 MW of capacity in power stations using 100% hydrogen.

To ensure a level playing field, the German federal government is advocating for ambitious sustainability standards to be agreed upon, further developed, and complied with across the globe. Also, the Federal Government is planning to diversify the supply of hydrogen and its derivatives by establishing bilateral and multilateral cooperation formats with a large number of partner countries, regions and international organisations. For the Import Strategy to be successful, greater cooperation within the EU and with the countries neighbouring the EU (e.g. Norway, the UK, and North African countries) is of great importance. A focus here is placed on tapping low-cost potential for hydrogen production as effectively as possible and building durable import relations.

Learn more in the German Hydrogen and Derivatives Import Strategy report: https://www.bmwk.de/Redaktion/EN/Publikationen/Energie/importstrategy-hydrogen.pdf